Start-ups are inherently vulnerable because they don't have cushy income stream propping them up or a stockpile of cash that they can dip into if things go awry. Therefore they must ensure that they are successful 90% of the time and that failures are hard and fast.

The odds are clearly against entrepreneurs so this post is dedicated to helping you avoid the most common pitfalls so that you have a fighting chance of success.

The odds are clearly against entrepreneurs so this post is dedicated to helping you avoid the most common pitfalls so that you have a fighting chance of success.

A study of 101 failed start-ups by CB Insights revealed these top 20 reasons. However, as they say, you get three 3 kinds of lies: lies, damned lies and statistics. So I’ve gone with something more intuitive, based on my personal experience, that you may find more relevant.

Contrary to popular belief, education, skills and training give you more chance of success. So, I’ve categorised the reasons why start-ups fail according to things you can and can’t control.

Here’s my top 14 reasons why start-ups fail:

STRATEGY ISSUES – can be solved through more knowledge and skill

1. The business does not solve a customer pain or fulfil a need

Entrepreneurs often overlook this pivotal point. Everything else such as marketing, operations, accounting, treasury, etc, is secondary. If you service an unmet demand and do it relatively well, you will probably succeed.

How do you check whether you are solving a pain? A good starting point is to give a detailed description of who your target customer / client will be. How old are they, how much do they earn, do they have a family, do they go to the gym - how often, where do they shop, what do they typically eat, how frequently do they go on holiday and where do they go? You'll then be able to articulate why your product / service is a necessity in their lives and why they are likely to pay for it.

What next? Do a survey with a free tool like Survey Monkey. While this won't give you a definite indication that your potential customers will part with their cash, it will tell you if you're in the ballpark or whether you're barking up the wrong tree.

If you still think you're onto something then build your minimum viable product (MVP), approach your target audience (face-to-face is best) and ask them to buy your product. If they bite, do this 5 more times. Viola! You now have 'traction' and are on your way to riches.

We should also talk about the user-centred design (UCD) or user-driven development (UCD) frameworks which at all stages of the design process, considers the needs, wants and limitations of your end-users. Worthwhile for the development of many products and will hopefully mean you don’t have to pivot in 12 months time.

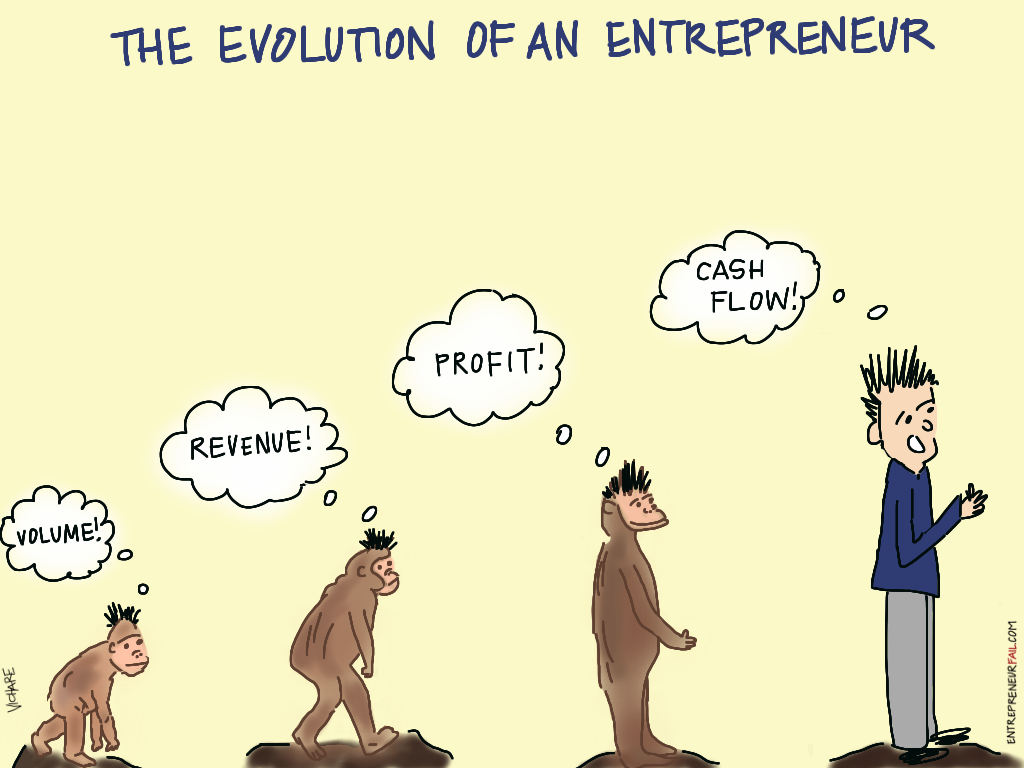

2. They don't make money

Subscribers, likes and followers don't pay the bills. Building a business that does not generate income is like building a house on sand and hoping there's some bedrock below. Just the other day I saw an e-commerce business that was generating revenues of £100m+ and growing at 20% p.a. but it was making losses and needed at least £15m funding over the next 3 years to break-even. It was funded by VCs and big banks. The arrogant founders weren't concerned about profits because they said that investors were so hungry that they were awash with cash. This time however, fools didn't rush in and the business went bust. A trade company bought it for a fraction of what it was 'worth' and everyone lost a lot of face and money! Remember: revenue is vanity, profit is opinion, cash is real.

Contrary to popular belief, education, skills and training give you more chance of success. So, I’ve categorised the reasons why start-ups fail according to things you can and can’t control.

Here’s my top 14 reasons why start-ups fail:

STRATEGY ISSUES – can be solved through more knowledge and skill

1. The business does not solve a customer pain or fulfil a need

Entrepreneurs often overlook this pivotal point. Everything else such as marketing, operations, accounting, treasury, etc, is secondary. If you service an unmet demand and do it relatively well, you will probably succeed.

How do you check whether you are solving a pain? A good starting point is to give a detailed description of who your target customer / client will be. How old are they, how much do they earn, do they have a family, do they go to the gym - how often, where do they shop, what do they typically eat, how frequently do they go on holiday and where do they go? You'll then be able to articulate why your product / service is a necessity in their lives and why they are likely to pay for it.

What next? Do a survey with a free tool like Survey Monkey. While this won't give you a definite indication that your potential customers will part with their cash, it will tell you if you're in the ballpark or whether you're barking up the wrong tree.

If you still think you're onto something then build your minimum viable product (MVP), approach your target audience (face-to-face is best) and ask them to buy your product. If they bite, do this 5 more times. Viola! You now have 'traction' and are on your way to riches.

We should also talk about the user-centred design (UCD) or user-driven development (UCD) frameworks which at all stages of the design process, considers the needs, wants and limitations of your end-users. Worthwhile for the development of many products and will hopefully mean you don’t have to pivot in 12 months time.

2. They don't make money

Subscribers, likes and followers don't pay the bills. Building a business that does not generate income is like building a house on sand and hoping there's some bedrock below. Just the other day I saw an e-commerce business that was generating revenues of £100m+ and growing at 20% p.a. but it was making losses and needed at least £15m funding over the next 3 years to break-even. It was funded by VCs and big banks. The arrogant founders weren't concerned about profits because they said that investors were so hungry that they were awash with cash. This time however, fools didn't rush in and the business went bust. A trade company bought it for a fraction of what it was 'worth' and everyone lost a lot of face and money! Remember: revenue is vanity, profit is opinion, cash is real.

3. They are not customer-focused

Customers are your business. Tailor your service to your customers needs and they'll follow you. Understand your customer needs 100% and deliver the exact service they need and you'll become very successful. A golden rule of business is that if you have limited resources then focus on your customers.

4. Addressable market is too small

If you followed my blog on Evaluating Your Business Idea, you would have already quantified the size of your market at the outset. For those of you who haven’t, don’t fall into the trap of wasting 2 years of your life and the bulk of your retirement fund just to find out that the pool of people who can afford your product or service is so small that you know them all on a first name basis. Assuming of course that you’re not starting a Ferrari garage.

5. The market is already saturated and you're just another me-too business

If you're going after someone else's lunch then you need to be smarter, leaner and stronger. Don't waste your time if you're just going to copy someone else's business model and let them beat you and your naivety with 20 years experience. You need to profit on competitor mistakes and differentiate yourself so that customers have a definite reason why they're switching to you.

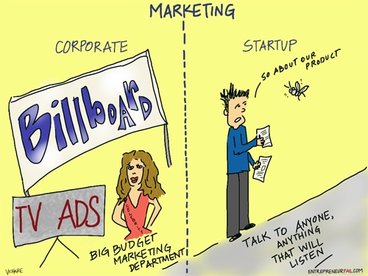

6. Poor marketing

Although marketing is a controllable cost which any accountant will tell you to minimise, I say the opposite. Work out your cost-per-acquisition (CPA) and as long as it is greater than the lifetime value of your customer, the payback period (PBP) isn’t too long and your cash flow can take the hit, then open the floodgates on marketing. Remember that 'lean' and 'well-funded' marketing are not mutually exclusive so don't unnecessarily burn cash. However, ensure that you give yourself every opportunity to reach the customers who are the cornerstone of your business.

FINANCIAL MANAGEMENT ISSUES – can be solved through more knowledge and skill

7. They run out of cash

Most start-ups go bust because of working capital, not because the business model is fundamentally flawed. Therefore it is imperative that you constantly focus on your financials. Your income statement is obviously very important but your cash flow statement is the lifeline for your business - ignore it at your peril.

I have heard of countless entrepreneurial businesses that have failed because they've grown too fast. Grown to fast? How can that be a bad thing you ask. In a nutshell, investment and growth and intrinsically linked and many items do not appear on your income sheet i.e. Inventory, the purchasing of machinery and debtors. All of these items suck up cash and even if your revenue is growing at 100%, you may still be heading for an iceberg.

8. Your cost base is too high / your pricing is not correct

Costs: Corporates are often bloated with unnecessary costs that ruin their profitability. You do not have this luxury as a start-up. Even if you're VC-backed, then get a CFO that is a stickler for costs. I recommend reading The Toilet Paper Entrepreneur before you launch your business because it'll get your frame of mind right.

Pricing: Inexperienced entrepreneurs usually don't charge enough and their margins are quickly eroded when a curve-ball is thrown at the business. "Price high and justify!"

PEOPLE ISSUES – possible to mitigate to some extent but often cannot be resolved

9. Co-founder conflict

Marriages unfortunately often end in divorce. The same is true of co-founder relationships. They like the green curtains, you want blinds.... You get the idea. There will be a million and one things that you may potentially disagree on.

My only advice here is to not choose a friend as your business partner firstly, so that you can remain objective on business decisions and secondly, if the relationship does need to end (see my post on Legal Agreements For Entrepreneurs), you can turn to your friends.

10. Team-investor politics

As a start, your team must have the same missions, aspirations and propensity for risk. Easier said than done and often you need a partner who is the ying to your yang so finding the right person is an art. Of equal importance, your investor needs to be aligned to your goals as much as possible. If your investor made all of their money in food retail and you're building a FinTech start-up, you may clash on how and when to spend money.

Entrepreneurs who have burnt their fingers will tell you that 'money is not just money - you get smart money and money that will ruin you and your dreams. Investors who've lost their shirts will tell you that 'not all entrepreneurs are created equal!' I read a pertinent quote the other day that went something like, "taking the wrong money for your start-up when you're desperate is like giving up your first-born to feed yourself today. You'll live to regret both."

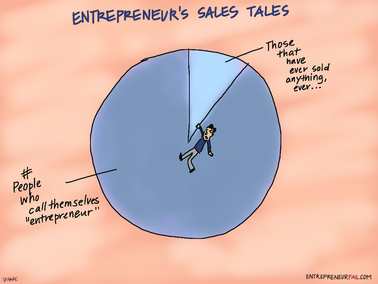

11. Lack of sales skills

If you want to start a business, you had better be good at selling. You have to sell your idea to your co-founder, sell your J-curve to investors, sell great prospects to your employees, sell your reliability to your suppliers and of course, sell to your customers.

OTHER – cannot be solved my micro-adjustment

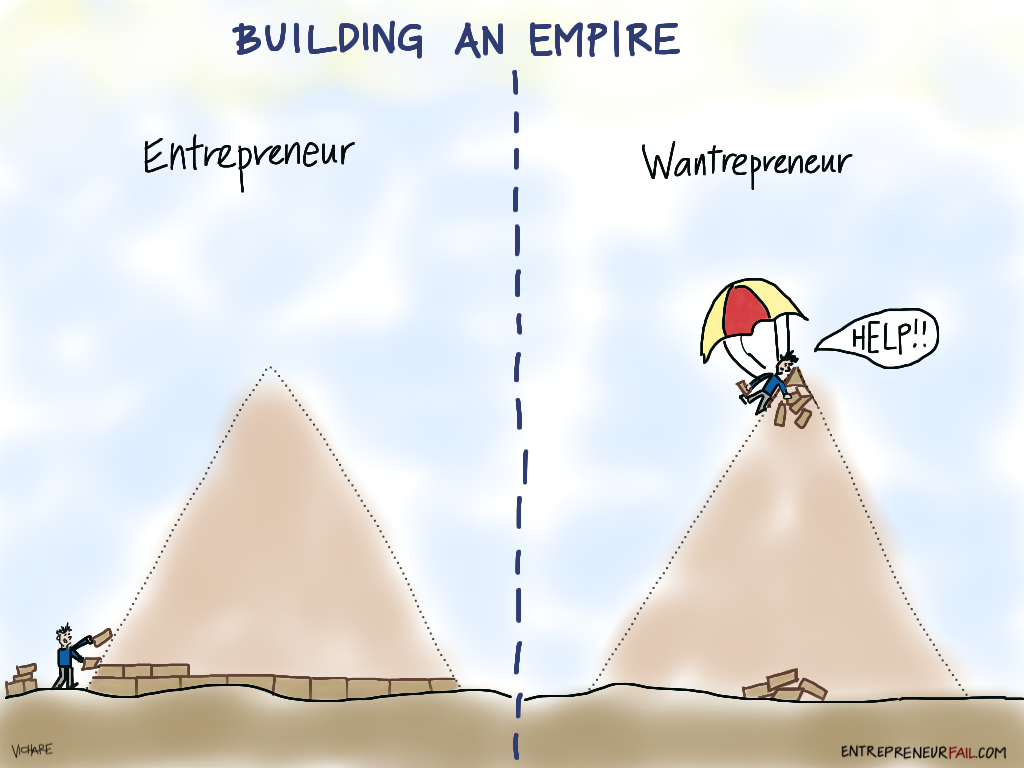

12. The founders are not entrepreneurs

This may seem like an unfair statement but just as some people are amazing at dancing and not great at maths and vice versa, some people cannot handle the uncertainty, ambiguity and financial pressure that comes along with being an entrepreneur.

Imagine if you're accustomed to receiving a cushy salary at the end of every month and suddenly one of your big clients doesn't pay or your funder delays your cash and you're left skint. Your brain is likely going to interpret the situation in the same way it would if an African lion was hurtling its way towards you. Fight or flight. Adrenaline, cortisol, norepinephrine all pumping through your veins. This won't exactly produce the level-headed mindset you're going to need to get yourself out of this situation. This is exactly why VCs are wary of corporate-types who say they're going to start their own venture.

Other people have had the (un?)fortunate experience of living hand-to-mouth and are all too familiar with eating canned tuna and rice for weeks on end. This is why many people say you should start a business straight out of University before you get used to the 'good' life provided by a corporate salary if you're lucky enough to have such opportunities... There are many other reasons to wait so it all depends on your personal circumstances.

13. Founder readiness

Previously I’ve discussed When To Start A Business. Some occasions are clearly better than others. A few things come to mind... If you aren’t financially secure you may suffer from a poverty mindset causing you to under-invest in your team, product or marketing. If your oppressive day job has finally worn you down, your leadership ability may need rekindling before you try to motivate a team. Lastly, if you’re just starting a business in a desperate attempt to not work for someone else you may suffer from an inability to communicate passionately to rally support and customers.

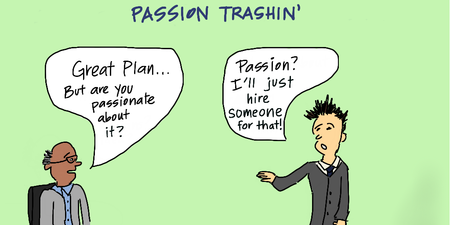

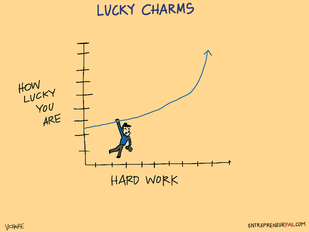

14. Lack of passion and domain expertise

Without passion you cannot have innovation because without it you won't jump into the unknown. Ultimately you'll only satisfy your customers and beat your competitors if you are laser-focused on your goal and work tirelessly to get there. It is typically not clever strategies and one-off strokes of brilliance that lead to success. There is no substitute for hard work and determination. It's therefore advisable to go into something that you either know lots about or that ignites a fire in your belly. That being said, it doesn't have to be a specific sector or product. I am passionate about building businesses and making them succeed which is enough for me.

Conclusion

Wow, no wonder the entrepreneurial path feels like navigating an icy cliff during a blizzard. Hang in there and remember to find a stress relief technique to help you on this turbulent journey. Ultimately, while unfortunate, it is not a disaster if your business goes under... They can't all be winners and next time you'll just be wiser and better prepared!

Ciao,

Alex @thetippytopblog

Please Like, Share, Follow and Subscribe to The Tippy Top!

Twitter | Facebook | Instagram | LinkedIn | Snap | BlogLovin' | Medium | Pinterest

Thank you to my friend Marc Low and brother Jonathan Leigh for contributing to and editing this post.

Tags:

#entrepreneurship #pivot #failure

Wow, no wonder the entrepreneurial path feels like navigating an icy cliff during a blizzard. Hang in there and remember to find a stress relief technique to help you on this turbulent journey. Ultimately, while unfortunate, it is not a disaster if your business goes under... They can't all be winners and next time you'll just be wiser and better prepared!

Ciao,

Alex @thetippytopblog

Please Like, Share, Follow and Subscribe to The Tippy Top!

Twitter | Facebook | Instagram | LinkedIn | Snap | BlogLovin' | Medium | Pinterest

Thank you to my friend Marc Low and brother Jonathan Leigh for contributing to and editing this post.

Tags:

#entrepreneurship #pivot #failure

RSS Feed

RSS Feed