Now, this is quite a lengthy blog post because there is lots to cover here but arguably it is one of the most important parts of starting a business so worth the upfront effort. Here goes!

It is probably best to write this document in a word editor and later you can convert it to something visually attractive in PowerPoint.

It is probably best to write this document in a word editor and later you can convert it to something visually attractive in PowerPoint.

When starting a business, I see 2 options:

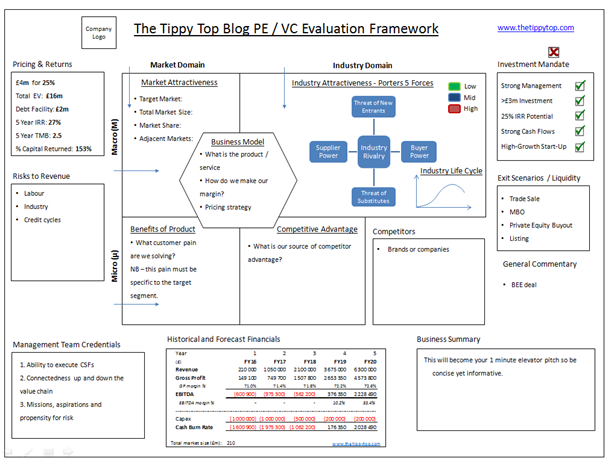

Professor John Mullins, who lectures at London Business School, wrote a book called The New Business Road Test – “what you should do before writing a business plan.” He developed a framework that can be used by entrepreneurs to evaluate businesses. I have used his framework numerous times and I think it is quite something. It is the base for this blog post - I have added some extra bits of detail and anecdotes from things that I have learned along the way.

So, here is the enhanced business evaluation framework:

- Start your business and then most likely realise after a while that you charged off in the wrong direction and that you have wasted lots of time and energy – now maybe you’ll be lucky....., but the stats are against you here.

- Spend a bit of time considering the merits and demerits of your idea and then do it properly. I am not saying that you shouldn’t start ASAP but rather than it is worth having the discipline to critically assess your idea to refine your thinking and the direction of the business.

Professor John Mullins, who lectures at London Business School, wrote a book called The New Business Road Test – “what you should do before writing a business plan.” He developed a framework that can be used by entrepreneurs to evaluate businesses. I have used his framework numerous times and I think it is quite something. It is the base for this blog post - I have added some extra bits of detail and anecdotes from things that I have learned along the way.

So, here is the enhanced business evaluation framework:

Business Summary:

Summarise your idea in 3-4 lines – this will help you distil exactly what your entrepreneurial venture is about. It can often be surprisingly difficult to articulate and will challenge you. If you are struggling, write out your idea as if you are explaining it to 4-year old. This will force you to explain your business simply and in an understandable manner.

As a random example, imagine we want to start a range of premium shampoos for women with long hair that we want to retail in London.

Ok now let’s start the evaluation process.

Market Domain – Macro:

People often get confused between markets and industries. Markets contain buyers (your customers) and industries contain suppliers (companies that will supply you and companies that will compete with you). It is good to use the right terminology to explain your business to potential investors.

Market Attractiveness:

Target Market / Audience:

Clearly define who your customers are and try be as specific as possible i.e. single women aged 20-30, living in London earning more than £40k per annum, with long hair. This will help you focus on exactly what customer pain you are solving (and for whom) and the maximum number of people to which you can potentially sell.

Market Size:

Venture Capitalists generally only invest in businesses that can capture a large market so while not everything, it is worth starting something that could generate high revenues.

Remember, it's all about the population, “We are interested in catching shrimp, not the whales. When you catch shrimp, then you will also catch the whales.” – start a business that captures lots of small customers and then you will start appealing to bigger customers. Going after large key-accounts in the first instance will unlikely be a fruitful exercise i.e. rather get loads of people buying your shampoo and then look ask competitors if they want to partner with you etc.

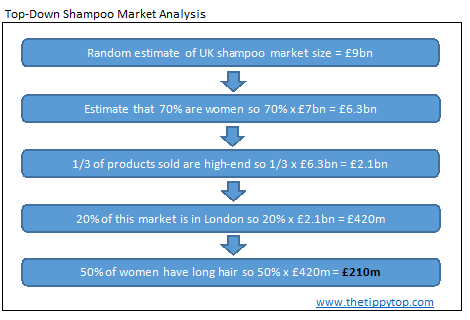

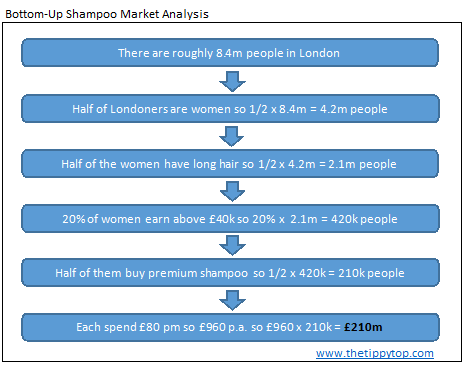

There are two (2) common ways to measure the size of the market.

1. Top-Down Approach – start with the total size of the market in terms of annual revenue i.e the shampoo market in UK is worth £9bn (this is a guess BTW). Then say that 70% of this spend is women, so 70% x £9bn = £6.3bn. Then say that 1/3 is low-end products, 1/3 mid-range and 1/3 high-end, so we multiply our £6.3bn by 1/3 to get £2.1bn. Then say that 20% of this high-end market is in London so £2.1bn x 20% = £420m. Then finally, say half the women in London have long hair so £420m x 50% = £210m. This figure is now the maximum amount of revenue that our business could ever generate, which is not bad. Often people will get over excited about the £9bn figure and keep saying "that’s why it is such a good idea," however in reality, an astute investor will not think very highly of you.

2. Bottom-Up Approach – There are circa 8.4m people in London. About half are women, so roughly 4.2m. Then about half have long hair, so 2.1m. About 20% earn above £40k, giving 420,000 people. As a guess, maybe 1/2 of them buy premium shampoo so now we’re down to 210,000. On average they spend £80 per month on shampoo which equates to £960 per annum each, meaning ~£201m total revenue.

Now you’ll notice that the two figures are the same (I didn’t cheat much I promise!) which generally means that your answer is in the ballpark and this will give potential investors some confidence that you know what you are talking about.

Gathering the information for this exercise will take a while but it is a really important step in your planning, so it’s worth it.

Interestingly, I have heard all sorts of ways to get market size figure – right down to waiting outside factories and bribing the workers to tell you how many machines the company has, how many hours they work etc, then researching the specs of the machine and working out how many products the company produces per year. This guy sold his business for a large sum BTW so clearly it’s worth being innovative!

Market Trends and Growth:

First question is whether the market is growing or contracting and at what rate? What is your projection for the next five(5) years and what is the proxy (thing that is causing) this growth. I would say that the premium shampoo market is growing and this is primarily caused by the boom in the health and beauty sector. This is just an anecdote and doing research here is a good idea because when you speak to investors, the stats will then roll off your tongue and give you real credibility.

Market Share Attainable:

The market size exercise tells you the maximum revenue that your company could earn in one year, however the actual revenue will inevitably be only a fraction of this.

The main question you are asking yourself here is: ‘Is my business scalable or will it just be a mom-and-pop business that always struggles along.'

As a guideline, I would say that capturing 3% market share by year 5 is a reasonable estimate for a high-growth start-up. So in our example, 3% of c. £210m = £6.3m per annum, which is not bad. Assuming that you have EBITDA profit of £2.2m (EBITDA margin of 35%) and you can command an 8x earnings multiple then you can sell the business for £17.6m – this is good money in anyone’s book!

Some people will say silly things like: “if we can just capture 10% of the xyz market, then we’ll have revenue of £1bn” and it is usually start-ups that sprout this kind of nonsense. When you mention that those revenue figures would make them a FTSE 100 company, they look at you blankly and the silently re-consider. I am all for ambition, but a sensible plan is usually the best place to start and if you strike gold then consider yourself lucky because you can’t plan that.

Adjacent Markets:

If you have time, it is worth investigating adjacent market opportunities because it shows that the business has upside potential in different markets. I wouldn’t focus on this because it will distract your business plan firstly, and secondly it will distract you when you are trying to build up some critical mass in your primary target market. So for now, maybe just create a list of potential adjacent markets.

Market Domain- Micro:

Benefits of the Product / Service – Specifically for the Target Market:

This is the single most important component of your business because everything else you do is to support this function. Remember that customers will be the only reason that you exist so look after them.

From a customers’ perspective, businesses either:

- Solve a Burning Need – In our shampoo example, customers may be looking for a shampoo that doesn’t dry out their hair as much so that they can wash their hair daily without it feeling like straw.

- Reduce a Pain – Maybe make a shampoo that foams properly even in hard water so that they can use less (i.e. the ethereal recommended amount) and stop washing their money down the drain. Solving a cost pain is probably one of the most compelling Unique Selling Propositions (USPs).

Once you have established this, then I like to use something I learned from an Operations course to further drill down into your business’ requisite core strengths:

1. Order Qualifiers – The minimum qualities we must have in to compete for sales:

- Brand and Trust – the product must appeal to the high-end market and be trustworthy.

- Price – the price must be in the ballpark of the competition – so we can’t spent millions on R&D and then make our product’s price unsaleable.

2. Order Winners – What do we have to be good at to win orders (customers)

- Superior Chemical Composition - does not dry your hair out with daily use and foams adequately in all water types. If we get this right, people will then choose our product over the competition and we’ll start stealing market share.

Industry Domain - Macro:

Remember, industry is the sellers and market is the buyers – don’t confuse your terminology.

Industry Definition:

As with the market, start by defining exactly in which industry you are competing. For us, it’s the high-end FMCG cosmetics sector. This will help us identify our competitors and who all the relevant stakeholders will be in our business.

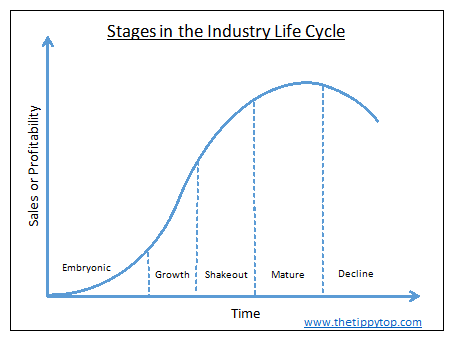

Industry Life Cycle:

This is a classic model of an industry life cycle and is a useful guide as to what characteristics you are likely to expect.

Briefly, the stages are characterised as such:

It is obviously easier to enter industries that are in the embryonic / growth phase but remember that you will be responsible for its growth (read: marketing spend, educating customers etc). Attacking a mature market means that it is easy to quantify the size of the prize but cannibalising a competitors sales will be not go unnoticed and they will try destroy you – this despite any presentation I have been to where big corporates say they aren’t like that.

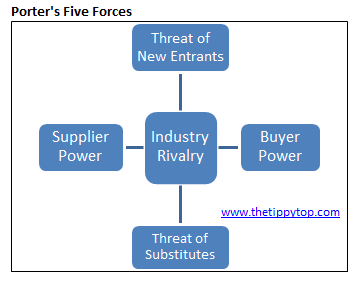

Industry Attractiveness (Porter’s 5 Forces):

Many moons ago, Michael Porter developed a great framework for assessing the attractiveness of an industry. An attractive industry means that the forces combined will lead to your business becoming more profitable over time with growing sales and similarly the opposite with an unattractive industry.

- Embryonic: Few competitors; low growth;

- Growth: Competitor entry; growing adopters;

- Shakeout: Weakest competitors fail; price cutting for volume growth;

- Mature: High barriers; no growth – market share and cash flow become the focus;

- Decline: Some competitors exit; declining revenue – all about cost cutting;

It is obviously easier to enter industries that are in the embryonic / growth phase but remember that you will be responsible for its growth (read: marketing spend, educating customers etc). Attacking a mature market means that it is easy to quantify the size of the prize but cannibalising a competitors sales will be not go unnoticed and they will try destroy you – this despite any presentation I have been to where big corporates say they aren’t like that.

Industry Attractiveness (Porter’s 5 Forces):

Many moons ago, Michael Porter developed a great framework for assessing the attractiveness of an industry. An attractive industry means that the forces combined will lead to your business becoming more profitable over time with growing sales and similarly the opposite with an unattractive industry.

If you work out that your industry is not attractive, by no means should you abort your business idea but rather just be aware of the likely challenges you will face.

1. Threat of New Entrants – Medium

How many other competitors / brands will decide to compete and enter this industry? Considering the high barriers to entry, not many start-ups are likely to try but large FMCG (Fast Manufactured Consumer Goods) companies might decide to launch a new range of shampoos and try to wipe us out.

2. Buyer Power – High

This refers to the bargaining power of your customers. I have rated this as ‘high’ because consumers have so much choice when choosing shampoos so you cannot for example double your price and expect them to keep buying your product. Buyer power would typically be low for industries like electricity supply because customers do not often have a choice but to use you.

3. Supplier Power – Medium

This refers to the company from whom you’ll be buying your raw materials and that will be manufacturing your products etc. Before you have scale, you will not have negotiating power because of your low order volumes. However, once you are selling 5,000 units a month, you will be able to squeeze their prices and demand better credit terms.

4. Threat of Substitutes – Low

This force asks whether customers can for example use beer to wash their hair instead of shampoo, meaning that they no longer need you. People have been using shampoo for a long while and nothing has really changed so this is unlikely.

5. Industry Rivalry – High

FMCG industries are extremely competitive. Margins are always under pressure and the big boys will always try to put you out of business through dirty tactics like selling their products at a loss (loss-leaders) until you can no longer fund your operations.

Overall I would rate the challenges of this industry as medium-high so the decision to enter this industry should not be taken likely and we need to be sure our product is truly revolutionary.

Industry Domain - Micro:

Competitive Advantage:

Why will we be better than the competition? It could simply be that because we are a start-up and can:

Ideally you want to have something tangible that truly makes you competitive such as:

Ask yourself whether this will give a sustainable competitive advantage or just an initial head start. Hopefully you’ll be able to build up a business ‘moat’ (like a castle) which basically means that competitors really struggle to attack your business. Coke for example have a moat and despite Pepsi’s efforts, they have yet to cannibalise coke’s market share to any meaningful degree.

Business Model

Our shampoo business has a very simple business model that everyone already understands but you could have something so new and innovative that people struggle to understand. Quidco for example really battled to get investment because people could not fathom that you buy something from a retailer for the same price as usual but also receive money back if they bought via Quidco – I’ll let you figure this one out yourself…

1. What is our product or service?

A range of premium shampoos that do not dry hair out and foam even in hard water. They will be sold through retailers and boutique hair salons.

2. How do we make our margin?

Source chemicals cheaply, manufacture on the back of a large existing operating and then let retailers handle the distribution. The low input costs and high selling price leaves plenty of margin for both the retailers and our shampoo business.

Always focus on achieving a high Gross Profit (GP) margin % because this is where the money flows from. Target a 70% - 80% GP as a guide. Even with such a such a high margin, you will be surprised how little trickles down to the bottom line. Apparently a 10% - 15% GP margin is the minimum you should accept but personally I wouldn’t waste my time on business models like this because if your variable costs unexpectedly go up slightly, it will wipe you out.

3. What is our pricing strategy?

We are solving a need and a pain so customers are likely to pay a premium for our product (well we hope so!). So we will price at the same levels of the top shampoo brands.

We will need to cannibalise competitor sales initially somehow so we need to create a compelling reason why customers will switch to our product despite all the other brands claiming they are just as good as ours.

In order not to cheapen the value of our brand, we will not discount but rather offer small free samples to get customers to try our product. This represents a large cost so we will need to factor this into our cashflow forecasts.

Risks to Revenue

What uncontrollable forces could possibly influence our market or industry and destroy our sales. Think of Uber’s current situation where they are partially and fully banned in certain countries/states such as Germany, Brussels and Nevada. This is legislated by the government and if those were our primary markets, our business would be no more.

In the London shampoo market, we may be subject to strict Health & Safety testing that costs a fortune for our small business and could ruin us. Also, we may get accused of testing on animals or something and that could destroy our brand – these types of rumours are often started by competitors so do not underestimate how ruthless they can be! This exercise is easy - just ask a person who you know to be negative (I hope you don't hang out with these kinds of people) and they'll spill out loads of reasons why you'll fail. Take no notice of course.

Competitors and Potential Competitors

If you don’t know of any competitors, it usually means one of two things:

Really spend a lot of time here because it will save you many costly lessons that your competitors have already learned. It will also help you expose competitor weaknesses, find gaps in the market and understand why you have a competitive advantage.

Price must be a key area of due diligence – look at their range of products, the sizes and shapes of the packaging idea.

Realise that your competitors have been thinking about and doing this for many years before you so while it may be a case that they can’t see the wood for the trees, often you can learn a thing or two...

Now I don’t have the first idea about competitors in our shampoo target market and you should spend loads of time researching here so I am not going to insult you by Googling a couple of names and writing them down like I know what I am talking about.

Team Credentials

Putting a team together involves slightly more than phoning up your mates and selling them on your million Pound idea.

Firstly, do not go into business with friends or family. This is seriously bad idea because statistics show that most businesses fail and that’s why things get nasty. So the likelihood is that you’ll lose your business and your friends / family.

I will caveat this by saying that I work well with my brother, mother and there are a very select few friends who I would go into business with. However, these people are hard workers, emotionally evolved and we can be honest with each other without it being an issue. If you don’t have this conviction then rather make your money independently and invite you family and friends to share the spoils on your yacht!

Moving on, there are three main categories that you should use to evaluate your proposed team. Venture Capitalists (VCs) buy into teams not individuals so get this right:

1. Ability to Execute Critical Success Factors (CSFs)

Can we do the work or do we need a bunch of expensive consultants in order to launch the business i.e. it is probably a bad idea to have you and your 3 biochemistry classmates start a business. Generally you need a:

2. Connectedness Up and Down the Value Chain

Remember the college friend who could source cheaply – find people who have contacts in your industry. This is extremely helpful and why cultivating a strong network is always a good thing. Part of the appeal of business schools is the network to which you gain access and why business school graduates often do well. More on this in other blog posts.

3. Missions, Aspirations and Propensity for Risk

Do not underestimate this factor. If you are a risk-prone entrepreneur who is willing to put everything on the line for a shot at making it big and your co-founder is a conservative guy who has his pension, mortgage and picket fence – you will constantly argue about business decisions. They will probably also prioritise their stable day job over your risky start-up and consequently not give your business the time and attention it deserves.

Remember that an experienced advisory board can make up for some of the gaps within your team. Having credible people involved in your business will make you stand out from the crowd.

Financials

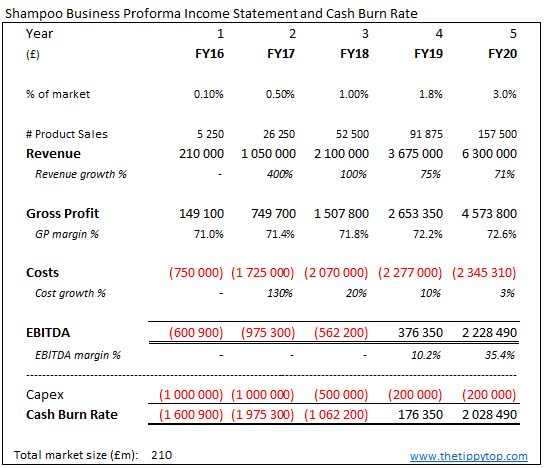

I wouldn’t be exhaustive here but it is worth putting together a basic 5-year Profit and Loss (P&L) statement and a list of cash expenses (capex) so you roughly understand how much capital you need to start the business.

Things you should calculate:

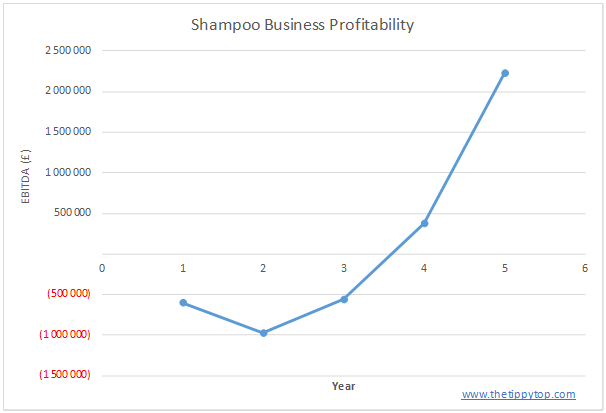

Below I have quickly put together a Profit & Loss Statement (P&L) and profitability curve for our shampoo business – you will notice the stereotypical J-curve that VC always look for i.e. the business makes losses initially and then suddenly takes off and becomes increasingly profitable. Please see my VC blogs for more detail here.

1. Threat of New Entrants – Medium

How many other competitors / brands will decide to compete and enter this industry? Considering the high barriers to entry, not many start-ups are likely to try but large FMCG (Fast Manufactured Consumer Goods) companies might decide to launch a new range of shampoos and try to wipe us out.

2. Buyer Power – High

This refers to the bargaining power of your customers. I have rated this as ‘high’ because consumers have so much choice when choosing shampoos so you cannot for example double your price and expect them to keep buying your product. Buyer power would typically be low for industries like electricity supply because customers do not often have a choice but to use you.

3. Supplier Power – Medium

This refers to the company from whom you’ll be buying your raw materials and that will be manufacturing your products etc. Before you have scale, you will not have negotiating power because of your low order volumes. However, once you are selling 5,000 units a month, you will be able to squeeze their prices and demand better credit terms.

4. Threat of Substitutes – Low

This force asks whether customers can for example use beer to wash their hair instead of shampoo, meaning that they no longer need you. People have been using shampoo for a long while and nothing has really changed so this is unlikely.

5. Industry Rivalry – High

FMCG industries are extremely competitive. Margins are always under pressure and the big boys will always try to put you out of business through dirty tactics like selling their products at a loss (loss-leaders) until you can no longer fund your operations.

Overall I would rate the challenges of this industry as medium-high so the decision to enter this industry should not be taken likely and we need to be sure our product is truly revolutionary.

Industry Domain - Micro:

Competitive Advantage:

Why will we be better than the competition? It could simply be that because we are a start-up and can:

- Better connect with our customers;

- Be more nimble, make quicker decisions and react faster to changing market conditions; or

- Be a cooler brand than a large corporate.

Ideally you want to have something tangible that truly makes you competitive such as:

- Ten years experience in biochemistry, developing innovative shampoos;

- A new technology that allows us to doing something cheaper, better, faster;

- A cheap source of raw materials through a college friend; or

- An ex-colleague that is an expert at social media marketing.

Ask yourself whether this will give a sustainable competitive advantage or just an initial head start. Hopefully you’ll be able to build up a business ‘moat’ (like a castle) which basically means that competitors really struggle to attack your business. Coke for example have a moat and despite Pepsi’s efforts, they have yet to cannibalise coke’s market share to any meaningful degree.

Business Model

Our shampoo business has a very simple business model that everyone already understands but you could have something so new and innovative that people struggle to understand. Quidco for example really battled to get investment because people could not fathom that you buy something from a retailer for the same price as usual but also receive money back if they bought via Quidco – I’ll let you figure this one out yourself…

1. What is our product or service?

A range of premium shampoos that do not dry hair out and foam even in hard water. They will be sold through retailers and boutique hair salons.

2. How do we make our margin?

Source chemicals cheaply, manufacture on the back of a large existing operating and then let retailers handle the distribution. The low input costs and high selling price leaves plenty of margin for both the retailers and our shampoo business.

Always focus on achieving a high Gross Profit (GP) margin % because this is where the money flows from. Target a 70% - 80% GP as a guide. Even with such a such a high margin, you will be surprised how little trickles down to the bottom line. Apparently a 10% - 15% GP margin is the minimum you should accept but personally I wouldn’t waste my time on business models like this because if your variable costs unexpectedly go up slightly, it will wipe you out.

3. What is our pricing strategy?

We are solving a need and a pain so customers are likely to pay a premium for our product (well we hope so!). So we will price at the same levels of the top shampoo brands.

We will need to cannibalise competitor sales initially somehow so we need to create a compelling reason why customers will switch to our product despite all the other brands claiming they are just as good as ours.

In order not to cheapen the value of our brand, we will not discount but rather offer small free samples to get customers to try our product. This represents a large cost so we will need to factor this into our cashflow forecasts.

Risks to Revenue

What uncontrollable forces could possibly influence our market or industry and destroy our sales. Think of Uber’s current situation where they are partially and fully banned in certain countries/states such as Germany, Brussels and Nevada. This is legislated by the government and if those were our primary markets, our business would be no more.

In the London shampoo market, we may be subject to strict Health & Safety testing that costs a fortune for our small business and could ruin us. Also, we may get accused of testing on animals or something and that could destroy our brand – these types of rumours are often started by competitors so do not underestimate how ruthless they can be! This exercise is easy - just ask a person who you know to be negative (I hope you don't hang out with these kinds of people) and they'll spill out loads of reasons why you'll fail. Take no notice of course.

Competitors and Potential Competitors

If you don’t know of any competitors, it usually means one of two things:

- You have a bad idea; or

- You have not done your homework properly.

Really spend a lot of time here because it will save you many costly lessons that your competitors have already learned. It will also help you expose competitor weaknesses, find gaps in the market and understand why you have a competitive advantage.

Price must be a key area of due diligence – look at their range of products, the sizes and shapes of the packaging idea.

Realise that your competitors have been thinking about and doing this for many years before you so while it may be a case that they can’t see the wood for the trees, often you can learn a thing or two...

Now I don’t have the first idea about competitors in our shampoo target market and you should spend loads of time researching here so I am not going to insult you by Googling a couple of names and writing them down like I know what I am talking about.

Team Credentials

Putting a team together involves slightly more than phoning up your mates and selling them on your million Pound idea.

Firstly, do not go into business with friends or family. This is seriously bad idea because statistics show that most businesses fail and that’s why things get nasty. So the likelihood is that you’ll lose your business and your friends / family.

I will caveat this by saying that I work well with my brother, mother and there are a very select few friends who I would go into business with. However, these people are hard workers, emotionally evolved and we can be honest with each other without it being an issue. If you don’t have this conviction then rather make your money independently and invite you family and friends to share the spoils on your yacht!

Moving on, there are three main categories that you should use to evaluate your proposed team. Venture Capitalists (VCs) buy into teams not individuals so get this right:

1. Ability to Execute Critical Success Factors (CSFs)

Can we do the work or do we need a bunch of expensive consultants in order to launch the business i.e. it is probably a bad idea to have you and your 3 biochemistry classmates start a business. Generally you need a:

- Techie;

- Marketing Guru.

- Finance Junkie; and an

- Operations Fundi;

2. Connectedness Up and Down the Value Chain

Remember the college friend who could source cheaply – find people who have contacts in your industry. This is extremely helpful and why cultivating a strong network is always a good thing. Part of the appeal of business schools is the network to which you gain access and why business school graduates often do well. More on this in other blog posts.

3. Missions, Aspirations and Propensity for Risk

Do not underestimate this factor. If you are a risk-prone entrepreneur who is willing to put everything on the line for a shot at making it big and your co-founder is a conservative guy who has his pension, mortgage and picket fence – you will constantly argue about business decisions. They will probably also prioritise their stable day job over your risky start-up and consequently not give your business the time and attention it deserves.

Remember that an experienced advisory board can make up for some of the gaps within your team. Having credible people involved in your business will make you stand out from the crowd.

Financials

I wouldn’t be exhaustive here but it is worth putting together a basic 5-year Profit and Loss (P&L) statement and a list of cash expenses (capex) so you roughly understand how much capital you need to start the business.

Things you should calculate:

- Expenditure required prior to launch (£1m);

- Cash burn rate per year (up to £2m) – make sure you can fund this; and

- Break-even number of sales (~85,000 @ £40 per product or £3.67m).

Below I have quickly put together a Profit & Loss Statement (P&L) and profitability curve for our shampoo business – you will notice the stereotypical J-curve that VC always look for i.e. the business makes losses initially and then suddenly takes off and becomes increasingly profitable. Please see my VC blogs for more detail here.

Exit Scenarios

It is all about the exit for investors but it should definitely not be your focus. If you want to exit the business before you’ve even started it then you shouldn’t bother starting. However, you should map out a couple of likely exit scenarios so that you make your business (look) investable.

Our shampoo business could be sold to:

- The retailers that we supply;

- FMCG competitors; or

- Private equity (PE) firms.

Go into detail here – don’t just say PE firms but be specific and list similar companies that those PE firms have recently purchased.

Conclusion

Do you have to go through this process for every idea? No of course not but if you are serious about an opportunity and want everyone else to be equally as excited then invest some time proving it will work.

I hope this evaluation framework continues to pay you dividends long into the future – it has certainly helped me assess many an opportunity.

If you managed to get through the whole blog, well done. I promise the next few posts will be much shorter!

Next up, we’ll go through a few vicarious business lessons that everyone should learn (the easy way).

Ciao,

Alex @thetippytopblog

Please Like, Share, Follow and Subscribe!

Twitter | Facebook | Instagram | LinkedIn | Snap | BlogLovin' | Medium | Pinterest

RSS Feed

RSS Feed