Prior to launching your business it is advisable to get your legal house in order. Having the tough conversations now will likely save many relationships and may shave years off your retirement age! Now remember that when you start a business, everyone is positive, happy and friends. Hopefully it stays that way but...

....in the likely event that something goes awry, having something in black and white is essential for dispute resolution. Reasonable people at the beginning will be reasonable people at the end so if you butt heads drawing up a fair agreement then do consider who you are jumping into bed with...

I’m obviously not a lawyer by any stretch of the imagination but I have done a short legal course and reviewed numerous legal agreements and trust me, they’re not that scary and are often just a complicated way of saying something pretty simple!

Drawing-up Legal Agreements

Unfortunately anything to do with the law is invariably costly, especially for your cash-strapped start-up. Luckily however, it is fairly easy to come up with the shareholders agreement in simple language and then once you have ironed-out everything with your co-founders you can give it to a legal professional to put it into legal speak. You will literally incur 1/10th of the cost.

I have separated this blog post into sections so you can see which clauses are important at which stage of your business but obviously this must all be agreed and drafted right at the start.

Clauses Important When Starting Your Business

Legal Entities

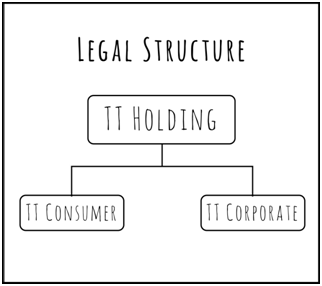

When setting up your company, I would strongly consider creating a holding company and then license the Intellectual Property (IP) to the trading company. This will protect your assets from being sued and taken away. It is a bit more upfront work (and cost) but it gives you far more protection and flexibility in the long-term. For example you can easily sell-off the consumer portion of your business and keep the corporate component or you can offer someone equity in part of the company without giving them equity in the main company. See the example structure below.

I’m obviously not a lawyer by any stretch of the imagination but I have done a short legal course and reviewed numerous legal agreements and trust me, they’re not that scary and are often just a complicated way of saying something pretty simple!

Drawing-up Legal Agreements

Unfortunately anything to do with the law is invariably costly, especially for your cash-strapped start-up. Luckily however, it is fairly easy to come up with the shareholders agreement in simple language and then once you have ironed-out everything with your co-founders you can give it to a legal professional to put it into legal speak. You will literally incur 1/10th of the cost.

I have separated this blog post into sections so you can see which clauses are important at which stage of your business but obviously this must all be agreed and drafted right at the start.

Clauses Important When Starting Your Business

Legal Entities

When setting up your company, I would strongly consider creating a holding company and then license the Intellectual Property (IP) to the trading company. This will protect your assets from being sued and taken away. It is a bit more upfront work (and cost) but it gives you far more protection and flexibility in the long-term. For example you can easily sell-off the consumer portion of your business and keep the corporate component or you can offer someone equity in part of the company without giving them equity in the main company. See the example structure below.

Equity

This is an extremely broad topic so I will only focus on the basics for this post.

The time when you’ll get lots of equity in a company is right in the beginning. They say that fights only start once you’re making money so please agree equity ownership while you are still in the red (loss making).

Also, getting shares later in a company is a BIG PROBLEM because it has major tax implications and you won’t have cash to pay it. Options don’t carry this tax so this is also fine if no equity is on the table. In the UK and some other countries, you don’t pay capital gains tax (CGT) until you sell your shares so you don’t have to worry about having enough cash to pay tax while you are still growing.

For two co-founders, ideally you want a 51% - 49% equity split. One person needs to have the final say on major decisions so that you do not constantly enter a stalemate. 50%-50% may seem more logical and fair, however it will likely cause you operational issues further down the line. Obviously negotiating who gets the 51% is a contentious issue but the upside is that after it’s done, every other decision will be easier. Remember that if you’re taking the bigger risk then you should get more equity upside.

Clauses Important When Running Your Business

Roles, Responsibilities and Targets

Write down what each person is responsible for and their objectives. Firstly, this ensures you have thought of everything that needs doing, but more importantly, it protects everyone if your co-founders are not working.

Also do set key performance indicators (KPIs) so that you and your team are working towards something tangible. They could be fairly normal or in the case of today's start-up world, you may choose to focus on something very customer-centric, examples include:

- x number of customers;

- y revenue; or

- z number of positive customer reviews.

In the blog post on Evaluating Your Business Idea, I mentioned that you and your team members must be have the same mission, aspirations and propensity for risk. Writing responsibilities down will help but if you are not aligned from the start, a piece of paper is not going to save your business. So be honest with yourselves and each other.

Voting Rights

It is important to know that equity ownership does not automatically dictate voting rights or company control. Investors often need more equity to compensate them for the cash they are supplying. For example, an investor may need 55% equity because of the capital they are providing at the current company valuation but this does not necessarily mean that you want them to dictate how you run your business.

So, you might consider giving your investor 1 vote and 2 votes each to you and your co-founder. This way you can both block your investor’s decisions but if one of you is doing something bad for the company, the investor and your co-founder can out-rank you 3-to-2. We’ll deal with investors in much more detail later but I just wanted to use the above scenario to convey the concept.

Minority Shareholder Protection Rights

Often owning less than 25% means that the other shareholders can pass certain resolutions without your consent, such as:

- Creating more shares;

- Appointing new directors; and

- Selling the assets.

So you need to ensure that minority shareholder protection rights are explicitly listed in your Shareholders Agreement.

Pre-Emptive Rights

Make sure you secure pre-emptive rights – these give you the first option to purchase shares in the following scenarios:

- If new shares are issued when you raise more funds – thus ensuring that your equity is not diluted. It goes without saying that you will need to pay for them but at least you have the opportunity to do so.

- If your partner wishes to sell their stake in the business – this prevents them from selling to a muppet who may ruin your company.

- If your partner dies and their husband/wife is in line to receive all of their shares – this stops the spouse from spending all the money and sinking your business.

Salaries

Salaries must be set and capped. Annual increases should be limited to inflation unless there is explicit agreement from all other shareholders. Remember that, in a start-up, high salaries rob the company of the chance to put that capital to use growing the long-term potential of the firm. So, they should only pay for bread and water until the company can afford market-related salaries. If someone complains about not getting a market-related salary, take it as a big warning sign and it is probably best if they go to the market...., you get the picture!

Benefits

Benefits are often a contentious issue. How, for example, would you feel if your business partner rented a Ferrari and took some potential clients out for a day at the horse races? Or imagine they decided it was necessary to fly Business Class to all their meetings to keep in tip top form…. Unhappy would be my guess! Setting these parameters at the beginning will reduce disputes and give your company a greater chance of success.

Dividends

Paying out dividends in a fast-growing company again means you are ruining your chances of creating a large successful organisation. The return on equity in ("ROE") your own business will be far higher than literally anything else you wish to do with the money so I would recommend putting at least a three (3) year freeze on dividends.

Disputes

Clearly define a dispute resolution procedure and nominate a third-party independent mediator to facilitate should it be deemed to be necessary under the circumstances. Do trust your intuition here and if you have a bad feeling about your co-founders at this stage, then walk away. Something else will come up and will probably be better.

Clauses Important When Selling Your Business

Call and Put Options

At some stage it may be necessary for one of you to exit the business for a number of reasons. For example, your partner may decide that they want to move to another country or want to start another business that is more in line with their personal interest. Either way, someone will be buying and someone will be selling, so you need a legal mechanism that guides this process.

A Call Option means an option to ‘buy’ the other shareholder out. Usually this would be after a specified period of time i.e. 2 years. A guideline price in established start-ups is 6-8x EBITDA (earnings before interest, tax, depreciation and amortisation).

Similarly, a Put Option is an option to ‘sell’ your shares to the other shareholders. You usually get a lower price if you want to sell so a 3-5x EBITDA multiple would be more common.

More than likely your start-up’s EBITDA will be too low to produce any sensible numbers so another commonly employed method is that two co-founders confidentially write down a price for the business. Then when they show each other, the person with the higher price then has the first option to buy-out the other at the lower price. This forces both parties to value the company fairly and I think it is a pretty good sale mechanism.

Leaver Rules

These are the rules that govern what happens when someone leaves the company. They are usually used to determine if and how much equity the person will retain when they leave. This typically applies to companies that take Venture Capital but worth thinking about now.

Below I have listed typical definitions of both types of leavers. BE CAREFUL because they can vary and may mean that you lose considerable value in certain circumstances.

Definition of Good Leaver:

- Where the Remuneration Committee determines the Leaver to be a Good Leaver;

- As a result of retiring from work at normal retirement age;

- As a result of being wrongfully or unfairly dismissed; or

- As a result of his death or permanent incapacity due to ill health.

Definition of Bad Leaver:

- He/she resigns and/or gives notice of the termination of his employment;

- He/she is made redundant;

- He/she is summarily dismissed (i.e. fired without a hearing); or

- He/she becomes a Leaver other than a Good Leaver for any other reason except where constructive dismissal has been determined by a court of competent jurisdiction.

If you are a Bad Leaver, you may be required to sell back your shares at par value (the value you paid for them) and chances are you paid very little for them but they are now worth a substantial amount now so this is going to be a big financial blow.

I have heard of horror stories where an entrepreneur is fired by his own Board and he was left with no shares and no value – this after he grew a successful company from scratch. Ouch! To protect against this, the entrepreneur should have put in place the following value vesting schedule for Bad Leavers i.e. if the they leave after x years, they sell their shares back to the company for y% of the market value.

- 1st year: 5%

- 2nd year: 30%

- 3rd year: 50%

- Ongoing: 50%

Tag and Drag Along Rights

We’ll deal with these more in the investors section so at this point it’s just worth being aware of them. Here’s a brief introduction:

- Tag Along Rights – this means that if for example >50% of the business is being sold, then you have the option to ‘tag’ along in the transaction and also sell your shares at the same valuation or you can block the sale.

- Drag Along Rights – If 85% of the company is being sold and you only own the remaining 15% then the other shareholders can ‘drag’ you along in the transaction and you will be forced to sell.

Closing Remarks

The most important thing to remember is that legal agreements are actually very basic so fear not. If you don’t understand something, don’t be afraid to ask seemingly silly questions because there is no such thing and questions usually help clarify the matter.

Remember to be confident with your approach because legal agreements are a key area where knowledgeable people often bully others because they assume that you don’t know any better. Shame on them!

I'll leave you with a gift someone special once gave me. When I was young boy, my Dad taught me an incredible life lesson that has been my guiding mantra through many tough situations: “In life you get what you negotiate, not what you deserve.” I hope it similarly serves you well.

Next I’ll give you a practical guide on starting a business and help you recruit (and retain) a solid team.

Cheers for now,

Alex @thetippytopblog

Please Like, Share, Follow and Subscribe!

Twitter | Facebook | Instagram | LinkedIn | Snap | BlogLovin' | Medium | Pinterest

Tags:

#entrepreneurship #legalagreements #startups

RSS Feed

RSS Feed